Cat Insurance – Pet Insurance claims for cats

Why insuring your cat is a good idea

The general consensus is that owning a cat is a lot cheaper than owning a dog. While this may be true, there are many potential hidden costs that come with cat ownership too. Budgeting for toys, cat food and flea medication is all very well, but what is harder to prepare for is the often unforeseen costs that will arise, mostly concerning your cat’s health.

While it’s expected that each cat will need some degree of veterinary care at some point throughout their lives, it is difficult to account for the more serious illnesses that can, and commonly do develop in cats as they mature. Although it’s true that dogs will (on average) cost more to care for over their lifetime, cats with serious health conditions will cost a substantial amount of money to care for too.

Cats do tend to have fewer veterinary visits overall, but when they do have an accident or contract illness, treatments can still run into thousands of dollars.

Outdoor cats are more at risk when it comes to health concerns simply because they are exposed to more. They encounter other animals, different insects and different foods or substances. They also tend to climb in places that are not as safe as being indoor and they can potentially end up near roads.

Having said that, this does not mitigate all the risk for indoor cats. Accidents can happen indoors and being indoors does not provide protection from common cat health issues.

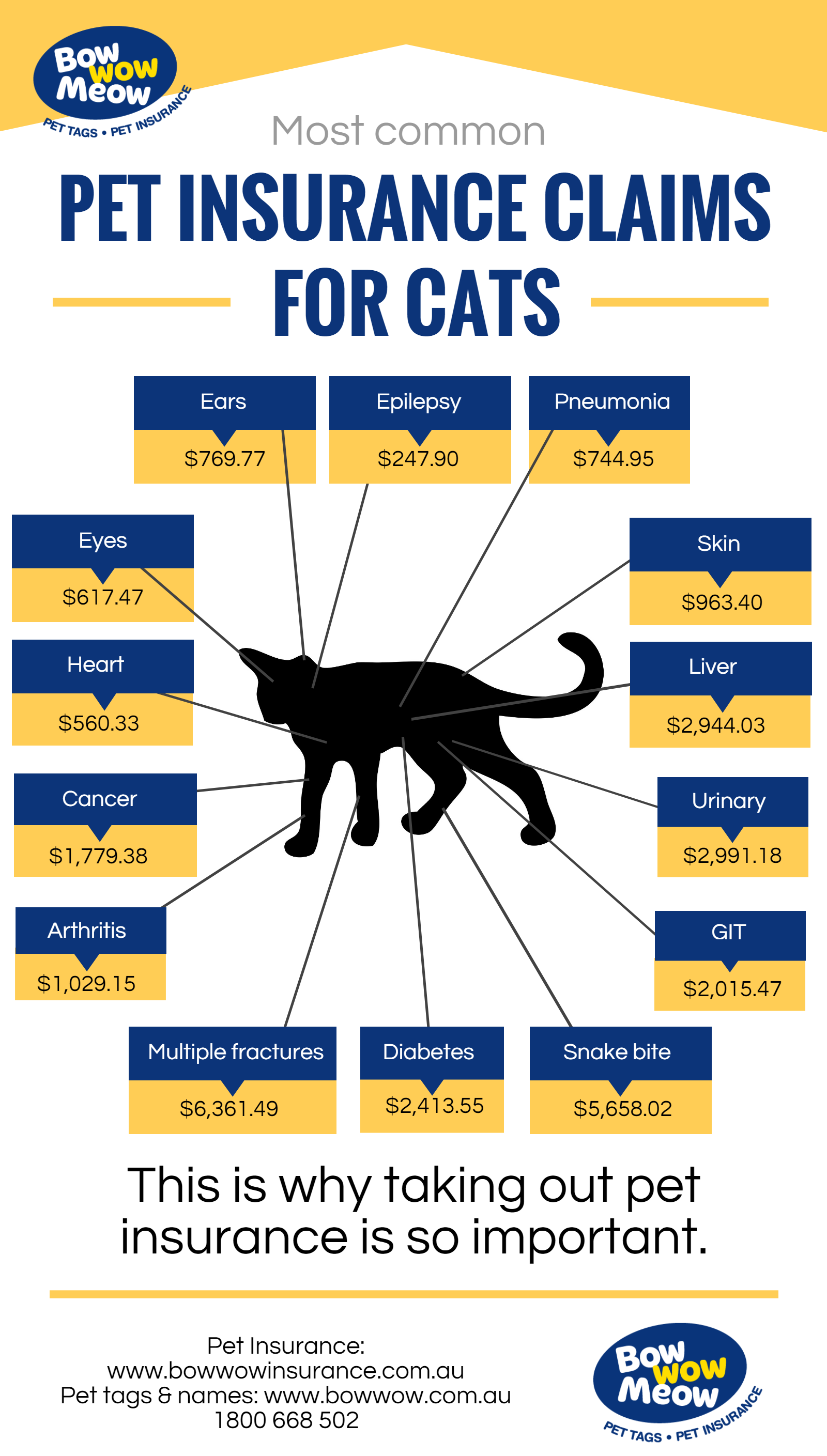

The most commonly claimed for health issues for cats include the following (based on our pet insurance data):

- Wounds

- Kidney disorder

- Vomiting

- Diabetes

- Abscess-bite

- Diarrhoea

- Urinary tract disease

- Viral infections

- Mass lesions

Other common health conditions include cystitis, cancer, thyroid disease and heart disease.

Since cats are more sedentary by nature and can be good at hiding symptoms (compared to their canine counterparts) it is often difficult to pick up if that something may be wrong. Often, if left too long without going to a vet, their condition can deteriorate, and you may be left with a very ill cat that requires expensive vet care.

Why is cat insurance important?

Since there is no Medicare for cats it is often difficult to fund large veterinary fees if an unforeseen event occurs, particularly when it is a serious accident or illness that can end up costing thousands. Pet insurance is an affordable way for owners to plan ahead for unexpected veterinary expenses. This is usually why owners choose to insure their cats as the other alternative is not a pleasant one (the only reason pet owners choose euthanasia is if there is really no way to treat your cat or if the cost is not affordable for the pet owner).

As you can see from the below table, some claims relating to cats are very significant, with the highest claim being a hefty $11,900 for a traumatic injury. Other claims such as cancer and autoimmune illnesses were also very costly (particularly when you consider that these are chronic illnesses).

Below are some of the highest claims that Bow Wow Meow has paid out for cats*:

| Accident / Illness description | Claim amount |

|---|---|

| Traumatic Injury | $11,900.00 |

| Autoimmune Neuromuscular Disease | $10,543.72 |

| Traumatic Injury | $9,655.96 |

| Immune mediated polyarthritis | $9,079.46 |

| Intervertebral Disc Disease | $9,041.09 |

| Sarcoma (Tumour) | $8,983.92 |

| Adenocarcinoma (Type of Cancer) | $8,966.47 |

| Intestinal Obstruction | $8,165.44 |

| Fracture of the Pelvis | $8,000.00 |

| Constipation | $7,897.80 |

*Based on claims for felines between Nov 2013 and July 2018

Kitten Insurance vs. Insurance for Older Cats

If you are a new kitten owner that is contemplating pet insurance, know that the best time to obtain pet insurance is when they are young and have no pre-existing conditions. If there are already existing health conditions (prior to getting a policy or within the 30 day waiting period), it will be excluded from cover. The only way to waive this condition is to apply for a pre-existing condition waiver, provided your cat has 18 months of continuous cover and has seen no signs of that condition throughout the 18 month period. Kittens can be covered from 8 weeks of age and they usually do not have any pre-existing conditions at this time so it is definitely a favourable time to get pet insurance. The average premium for a cat that is under 1 yr in age is around $360 p.a (this is an average and your cat’s premium will also depend on other factors).

If you apply for pet insurance when your cat is older than 8 yrs of age, you will only be eligible for Accident Only cover and you will not be able to obtain illness cover. You can get Accident and Illness cover for your cat before its 8th birthday (excluding pre-existing conditions), however, you will find that premiums at this level are more expensive as this is a high risk time when it comes to the likelihood of becoming ill. The average premium for cat that is between 9 and 10 yrs old is $586 p.a. (this is an average and your cat’s premium will also depend on other factors).

Average premium for cats in each age group

As per the graph below, it is interesting to note that the average premium for cats do not increase significantly throughout their life. It remains under $500 p.a. for the the first 5 years and then creeps up each year with the average premium for cats over the age of 11 yrs coming in at $654 p.a. Again, this is an average and it is important to know that individual premiums are affected by claims, postcode, breed and other variables.

Average premiums taken from the Bow Wow Meow book for cats, up until 30 May 2019.

Average premiums taken from the Bow Wow Meow book for cats, up until 30 May 2019.

While the cost of caring for a cat with illness can be expensive, especially once you consider the amount you’ll be spending on other items such as food, flea medication and kitty litter, having a healthy and happy cat at home can be a very rewarding experience. The best thing you can do is know what costs could be around the corner in order to prepare for if your cat does become sick—you’ll most likely need a number of vet visits, maybe even a surgery and ongoing medications. These costs can often be too expensive for people to afford. If in doubt, the best way to prepare for any illnesses your cat may develop is to organise cat health insurance. Many an owner can attest to just how life-saving cat insurance can be.

Pet Insurance reviews from cat owners